The Forgotten Middle: Housing & Care Options for Middle-Income Older Adults

New research conducted by NORC at the University of Chicago through a grant provided by The SCAN Foundation highlights the financial challenges facing middle-income older adults, building off of the findings from the 2019 “Forgotten Middle” study to understand their needs around accessing long-term care and housing support.

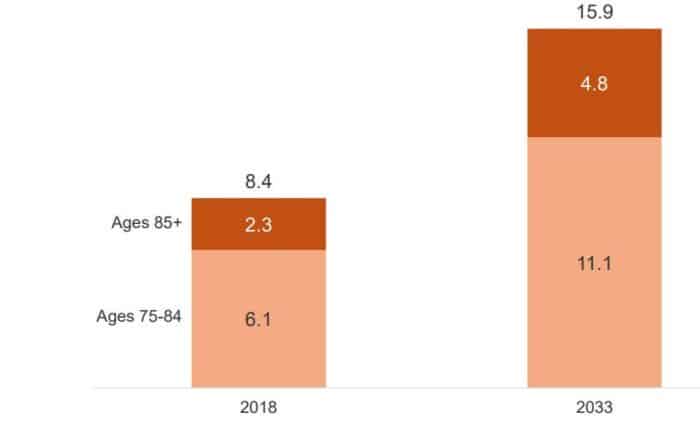

Principally, the study found that over the next decade, the number of middle-income older adults will almost double—reaching 16M adults ages 75+ by 2033. This group will be more racially and ethnically diverse, including 22% who are people of color. Many will have health needs, like mobility limitations and cognitive impairments, that make it hard to live independently. Further, it is plausible that many may be more reliant on paid caregiving since a majority of them will be unmarried in 2033, and many do not have children living nearby.

As baby boomers age, the size of the middle-income population will increase, especially among those ages 75-84, which will grow by 5M.

The expected reliance on paid care is may contribute to financial insecurity given that without selling their homes, three-quarters of middle-income older adults (11.5M) have insufficient resources to pay for private assisted living and many are reluctant to sell their homes either because their spouse still lives there or because it is a “nest egg” to protect against unforeseen expenses or pass to their children. Even with home equity, 6M (39%) middle-income seniors cannot pay for assisted living.

To read more about the methodology and findings, access the full report HERE